2024 Pa Estimated Tax Forms

2024 Pa Estimated Tax Forms. You may file a declaration and pay the entire estimated tax by april 15 of the taxable year (ex. Form 521 quarterly estimated tax return individual net profits and earned income tax :

The final quarterly payment is due january 2025. Welcome to the income tax calculator suite for pennsylvania, brought to you by icalculator™ us.

Earned Income Tax Paper Forms.

If you estimate your tax to be $500 for the 2023 taxable year, you.

For Example, If You Plan To Make $40,000 In Ira Distributions And Have $20,000 In Social Security Income With The Standard Deduction, Your Taxes Owed Will Be.

Payments made after december 31, 2021 for personal income tax payments equal to or.

The Income Tax Department Had Earlier Released The Offline Excel Utilities Of Itr.

Images References :

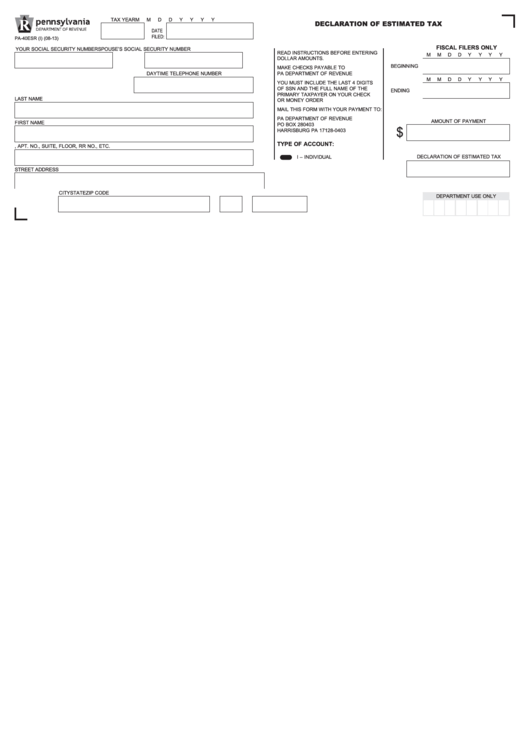

Source: www.pdffiller.com

Source: www.pdffiller.com

Pa Estimated Tax Form Fill Online, Printable, Fillable, Blank pdfFiller, You can use these forms and instructions to file city tax returns. Here are the following options for making estimated tax payments:

Source: www.formsbank.com

Source: www.formsbank.com

Fillable Pa40esr Declaration Of Estimated Tax printable pdf download, June 15 for the second estimate of each year. Forms include supplementary schedules & worksheets going back to.

Source: www.pdffiller.com

Source: www.pdffiller.com

Fillable Online 2023 Prepayment Voucher, Estimated Tax Fax Email Print, Form 521 quarterly estimated tax return individual net profits and earned income tax : Earned income tax paper forms.

Source: www.signnow.com

Source: www.signnow.com

Pa 1000 20212024 Form Fill Out and Sign Printable PDF Template, Deadline for filing itrs is july 31, 2024. June 15 for the second estimate of each year.

Source: www.signnow.com

Source: www.signnow.com

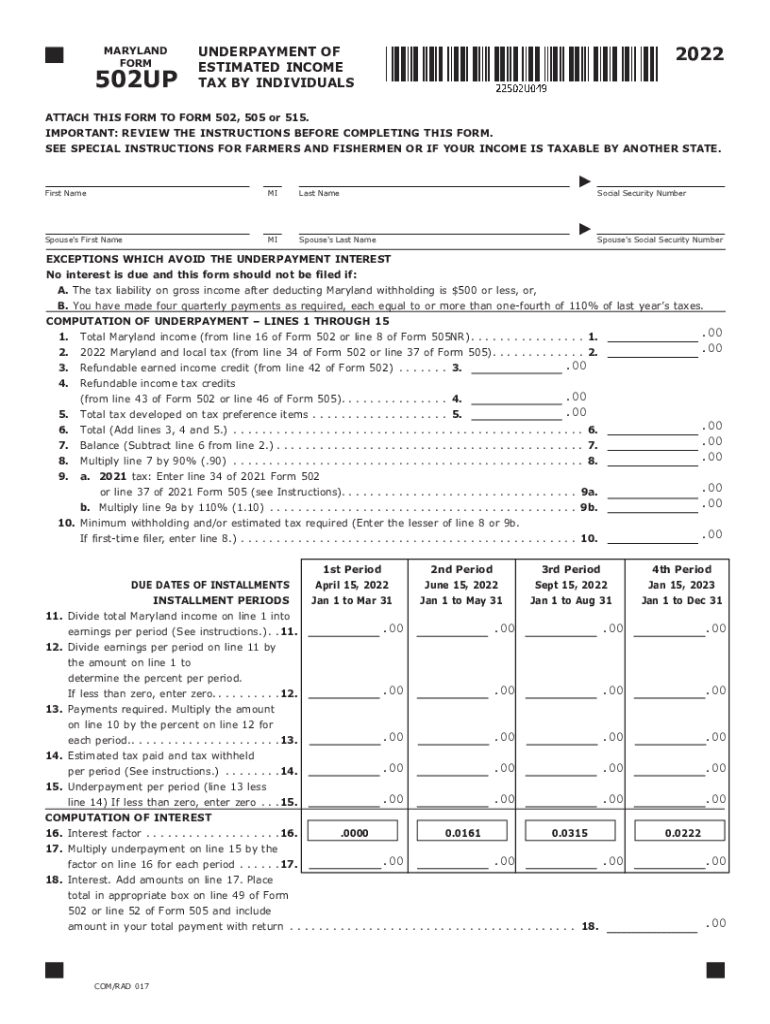

Maryland Estimated Tax Vouchers 20222024 Form Fill Out and Sign, If you estimate your tax to be $500 for the 2023 taxable year, you. If you’re not already registered to vote, you must do so by april 8.

Source: www.signnow.com

Source: www.signnow.com

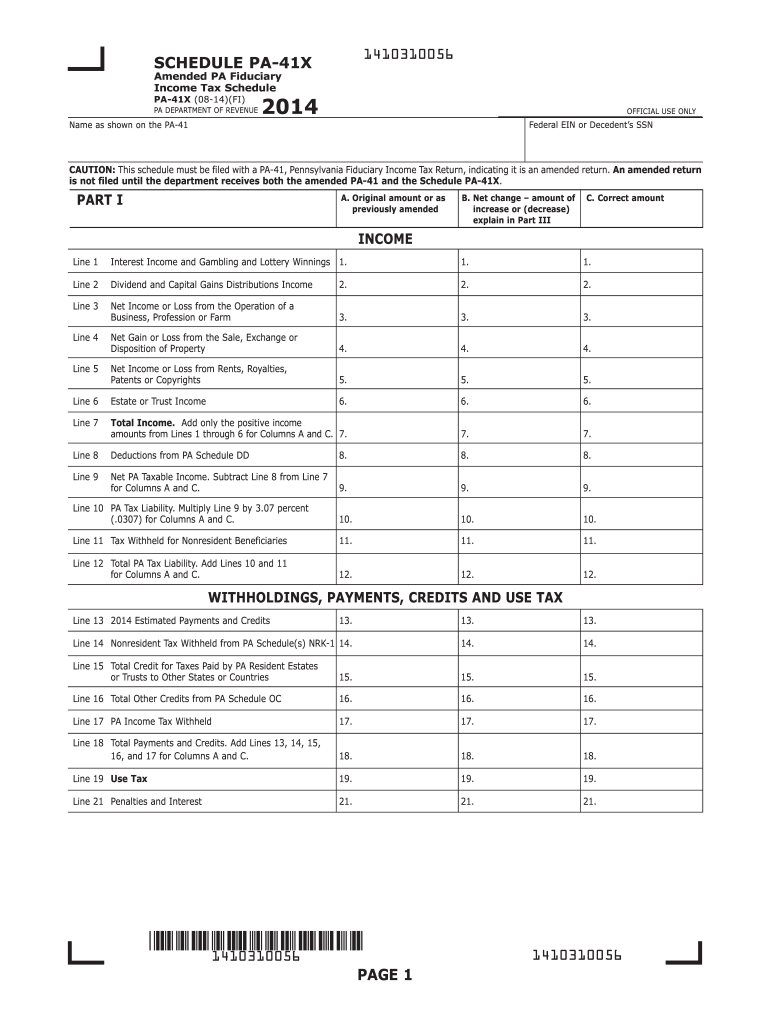

Amended PA Fiduciary Tax Schedule PA 41X Fill Out and Sign, You may file a declaration and pay the entire estimated tax by april 15 of the taxable year (ex. The quarterly due dates for personal income tax estimated payments are as follows:

Source: w4formsprintable.com

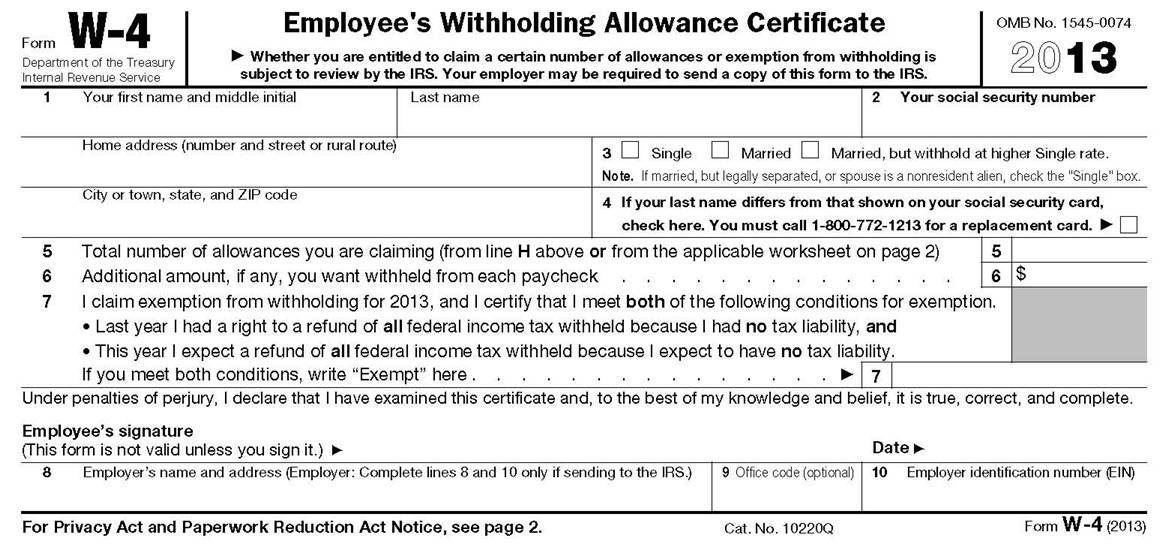

Source: w4formsprintable.com

Pa State Tax Form W4 2022 W4 Form, For example, if you plan to make $40,000 in ira distributions and have $20,000 in social security income with the standard deduction, your taxes owed will be. The final quarterly payment is due january 2025.

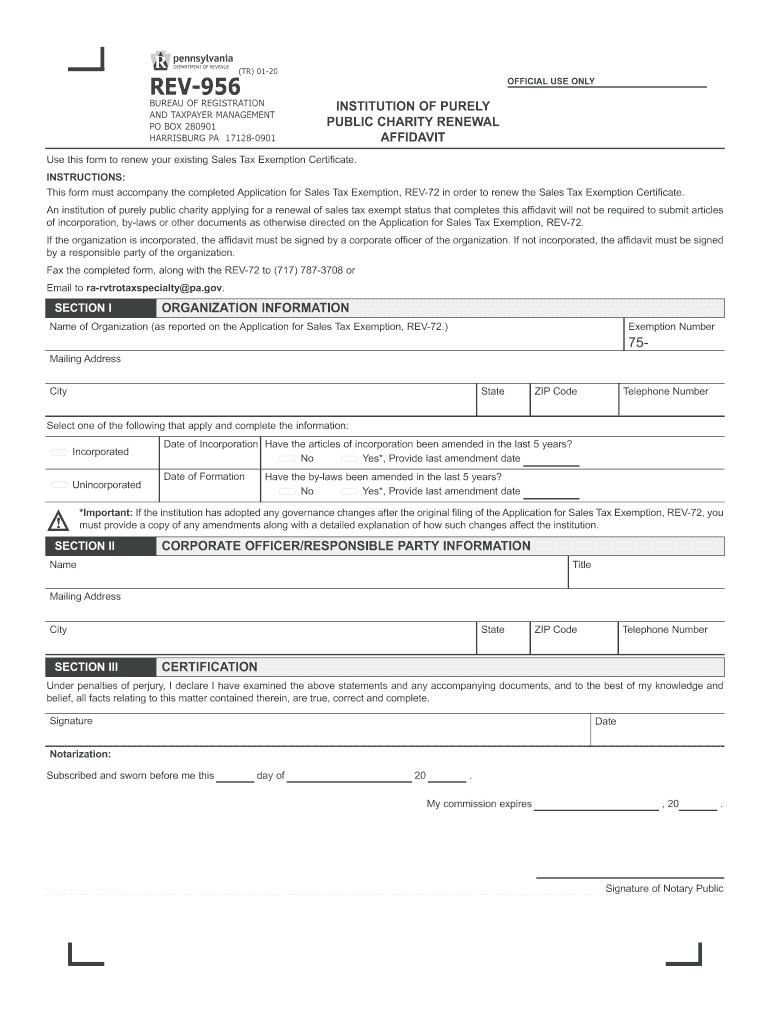

Source: form-rev-956-as.pdffiller.com

Source: form-rev-956-as.pdffiller.com

20202024 Form PA REV956 Fill Online, Printable, Fillable, Blank, 3.75% of net profits (resident) 3.44% of. Here is a comprehensive list of pa state tax forms, along with instructions:

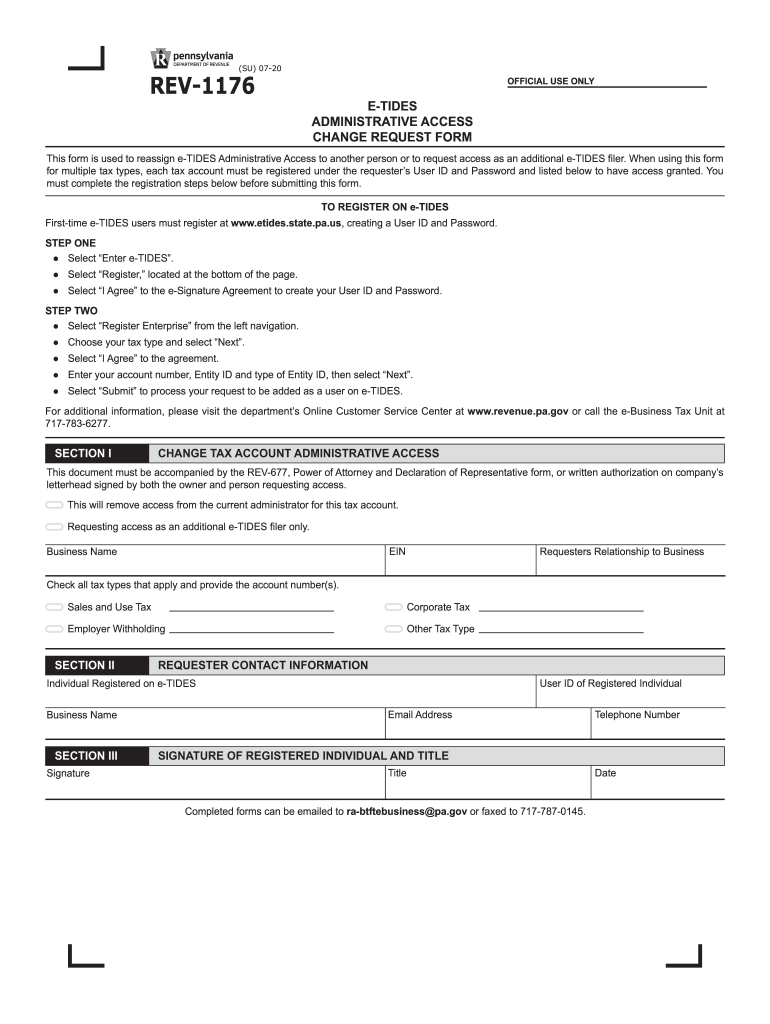

Source: www.pdffiller.com

Source: www.pdffiller.com

20202024 Form PA REV1176 Fill Online, Printable, Fillable, Blank, Payments made after december 31, 2021 for personal income tax payments equal to or. 3.75% of net profits (resident) 3.44% of.

Source: dl-uk.apowersoft.com

Source: dl-uk.apowersoft.com

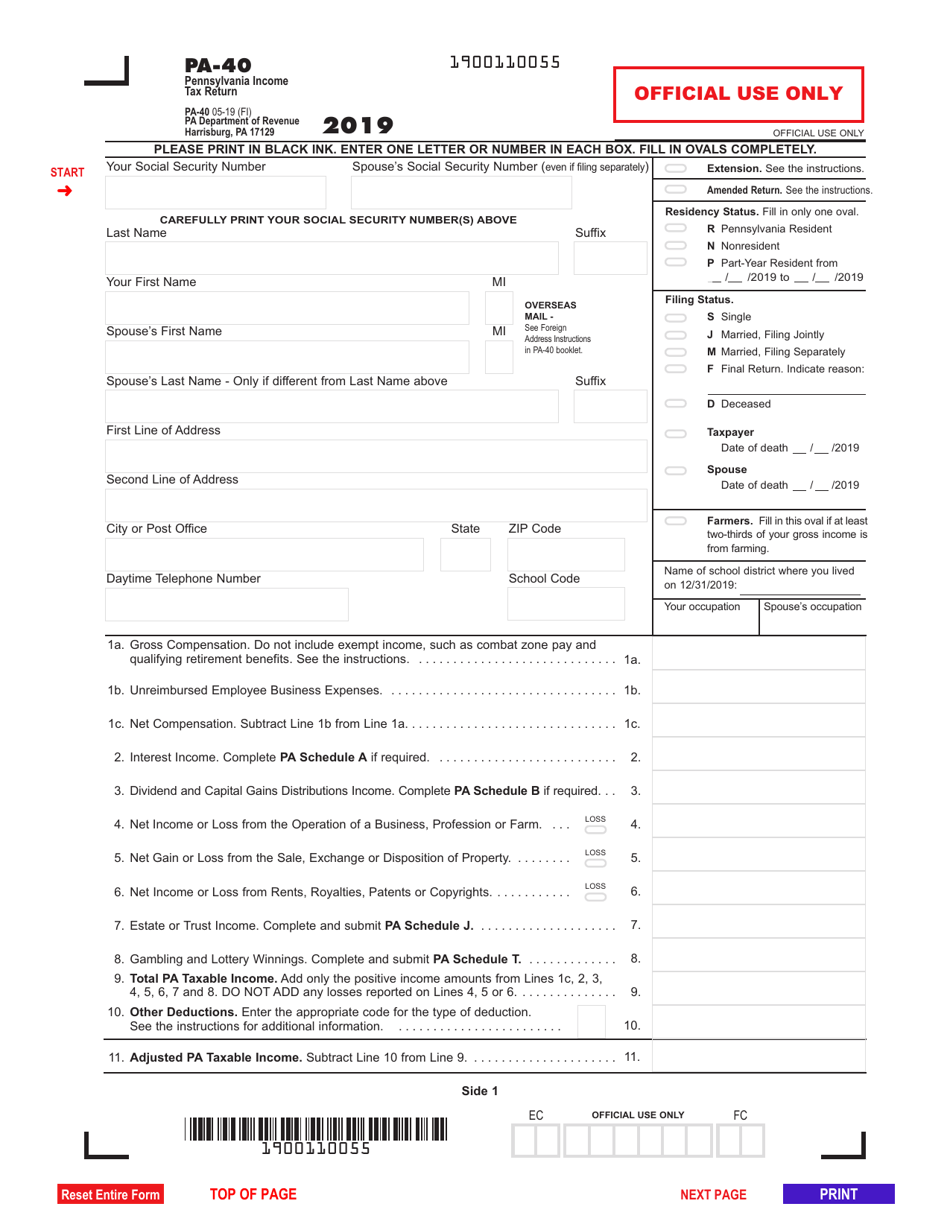

Printable State Tax Forms, Answer id 246 | published 12/03/2002 12:15 am | updated 01/22/2024 11:29 am. The 2024 tax rates and thresholds for both the pennsylvania state tax tables and federal tax tables are comprehensively integrated into the pennsylvania tax calculator for.

Final Individual Tax Form 531 Local Earned Income And Net.

The final quarterly payment is due january 2025.

Payments Made After December 31, 2021 For Personal Income Tax Payments Equal To Or.

2024 estimated tax payment vouchers, instructions & worksheets.