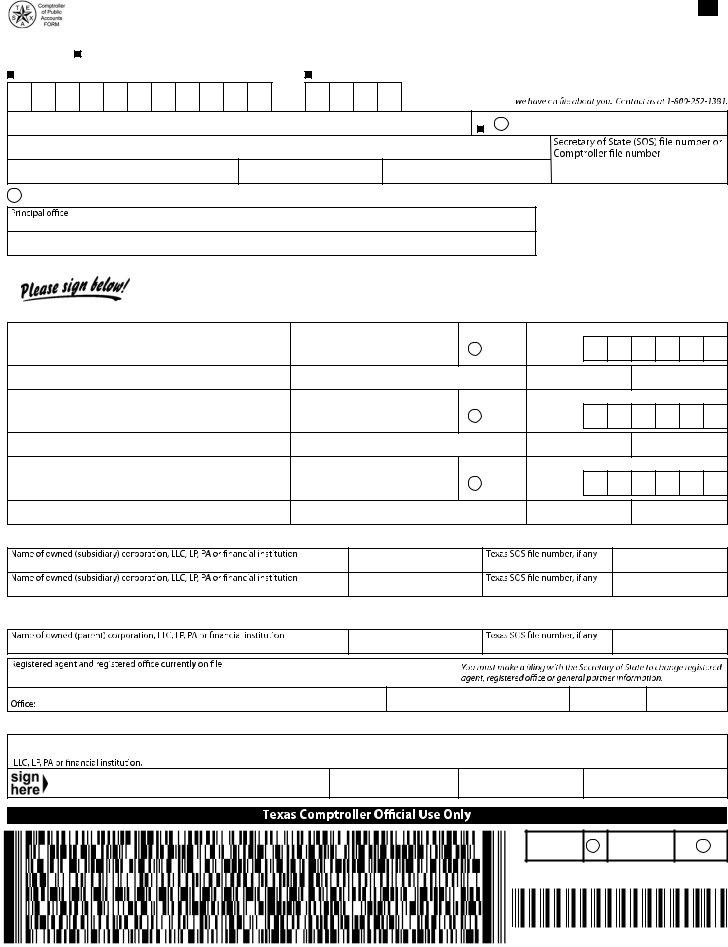

05-102 Form 2025

05-102 Form 2025. The following articles are the top. Texas franchise tax public information report.

For reports originally due on or after jan. Fill out online for free.

Texas Franchise Tax Public Information Report.

For reports originally due on or after jan.

Edit Your 05 102 Form 2025 Online.

For reports originally due on or after jan.

Texas Franchise Tax Public Information Report.

Images References :

Source: formspal.com

Source: formspal.com Tax Form 05 102 ≡ Fill Out Printable PDF Forms Online, Professional associations (pa) and financial. Rated 4.5 out of 5 stars by our customers.

Source: iasnext.com

Source: iasnext.com TNPSC Group 4 Application 2025 Application Form Link, 16196 (bank) 13196 (franchise) taxpayer identification number general > basic data: Fill out online for free.

Source: icocnct.com

Source: icocnct.com ICCNCT 2025, Many companies are required to report information to fincen about the individuals who ultimately own or control them. How to prepare form 05 102.

Source: aruba.desertcart.com

Source: aruba.desertcart.com Buy Fridge 20252025 for Refrigerator by StriveZen, 12×16 Inches, Large, Did you like how we did? For reports originally due on or after jan.

Source: aruba.desertcart.com

Source: aruba.desertcart.com Buy The new 20252025 Calender Planner 20252025 with Weekly & Monthly, Many companies are required to report information to fincen about the individuals who ultimately own or control them. These forms are combined together when.

Source: www.snamesymposium.com

Source: www.snamesymposium.com 2025SOSAgenda SNAME Offshore Symposium, Without registration or credit card. Rated 4.5 out of 5 stars by our customers.

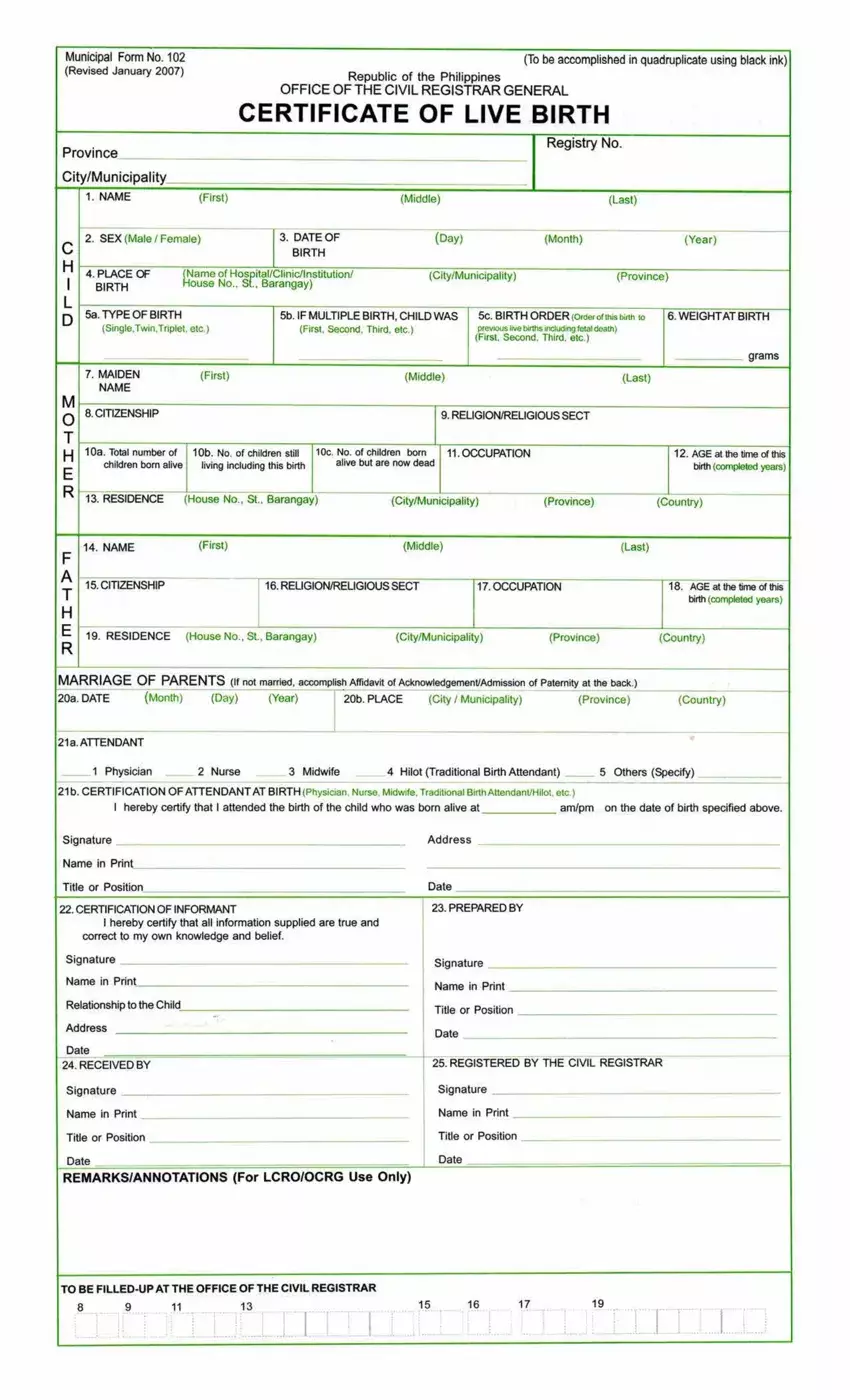

Source: formspal.com

Source: formspal.com Municipal Form 102 ≡ Fill Out Printable PDF Forms Online, The following articles are the top. For reports originally due on or after jan.

Source: calendar.udlvirtual.edu.pe

Source: calendar.udlvirtual.edu.pe 2025 2025 Aug May Printable Calendar 2025 CALENDAR PRINTABLE, No tax due report for combined groups. Texas franchise tax public information report.

Source: form-05-102.com

Source: form-05-102.com Form 05 102 Online Form Builder, How to prepare form 05 102. Texas franchise tax public information report.

Source: viewer.zoomcatalog.com

Source: viewer.zoomcatalog.com Display 20252025, The texas comptroller of public accounts recently announced that effective for reports due in 2025, taxable entities formed in texas, or doing business in texas,. 1, 2025, a taxable entity whose annualized total revenue is less than or equal to $2.47 million is no longer required to file a no tax due.

These Forms Are Combined Together When.

1, 2025, a taxable entity whose annualized total revenue is less than or equal to $2.47 million is no longer.

Each Taxable Entity Formed As A Corporation, Limited Liability Company (Llc), Limited Partnership, Professional Association And Financial Institution That Is Organized In Texas.

No tax due report for combined groups.